- ENGLISH

we have topped New Fortune’s Best Local Research Team category

in the China (A&B Shares) market by Asiamoney for 7 consecutive years

see more athttps://research.citics.com

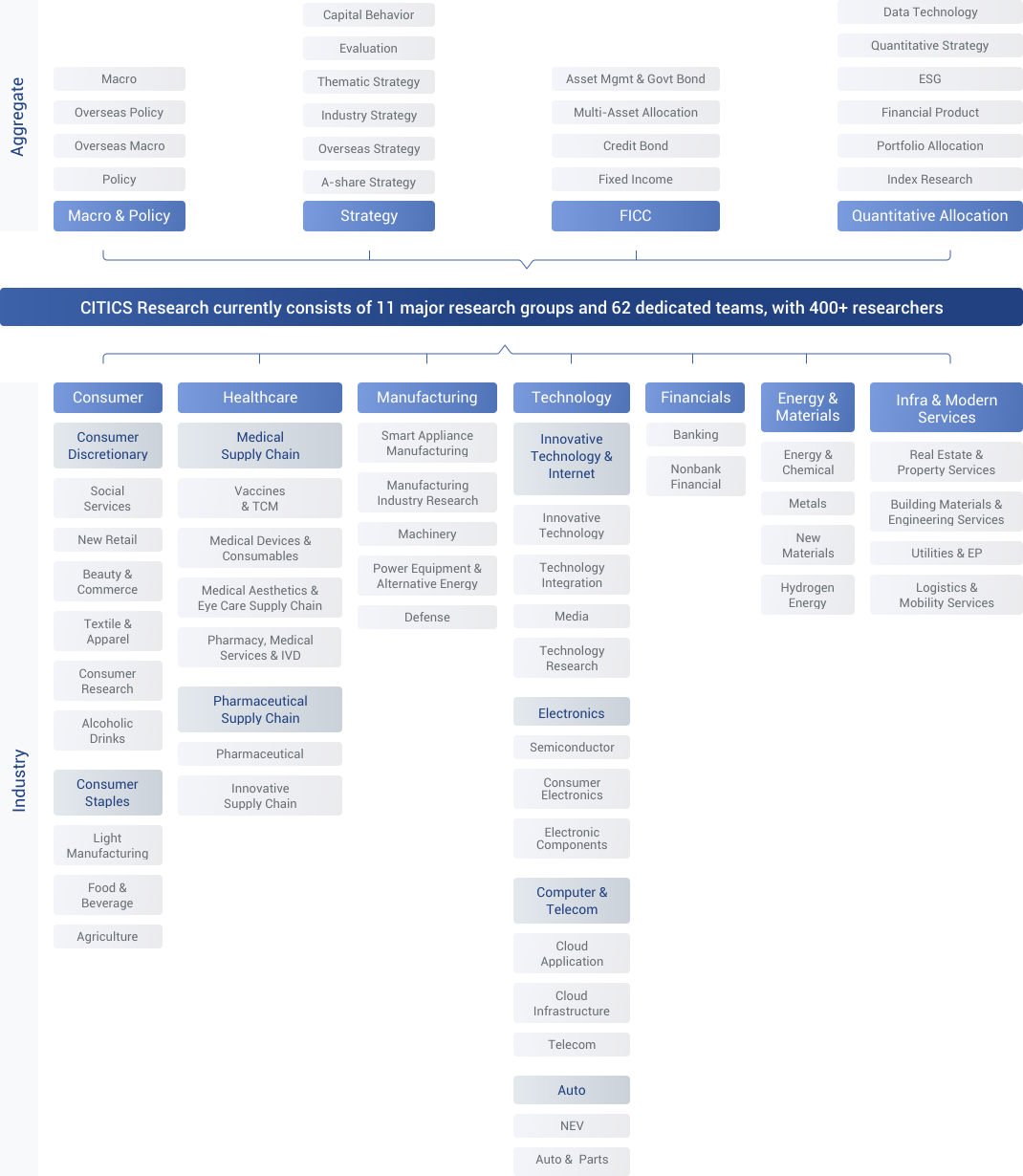

Every year, we present over 10,000 high-quality research reports of various types, covering aggregate, industry, sector and corporate researches. Our reports include in-depth/thematic reports, investment value analysis reports, survey/tracking reports, new stock analysis reports, commentaries, etc.

Currently, we cover 2,400+ A-shares, H-shares, US stocks and overseas-listed China concept stocks.

Our reports are distributed via our own website (https://research.citics.com), and can ben viewed via Xinetou app, Weixin official account (CITICS Research) and mini-program (CITICS Research Services), as well as major financial terminals like Bloomberg and Wind.

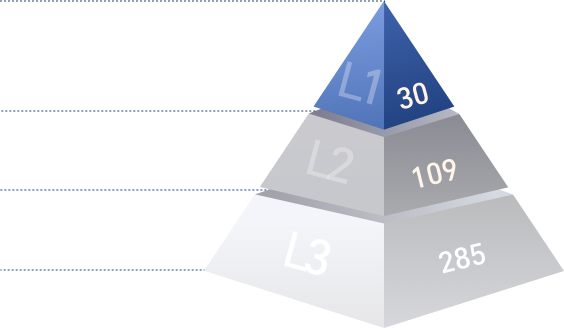

Classification standards covered (5,000+ SH-/SZ-listed firms, 2,500+ HK-listed firms, 300+ overseas-listed Chinese firms, 200+ BSE-listed firms, C-REITs)

Regular (annual) information disclosure

Medium-term governance improvement

Long-term green finance